Scenario:

A person receives an e-mail apparently sent by his Bank, which contains a link that allows the user to directly access the Bank's website. Unfortunately, the link does not lead to the official website but to a "cloned page", specially created to be identical to the official website. The cloned page has the scope to collect data that the victim enters to be used for fraud.

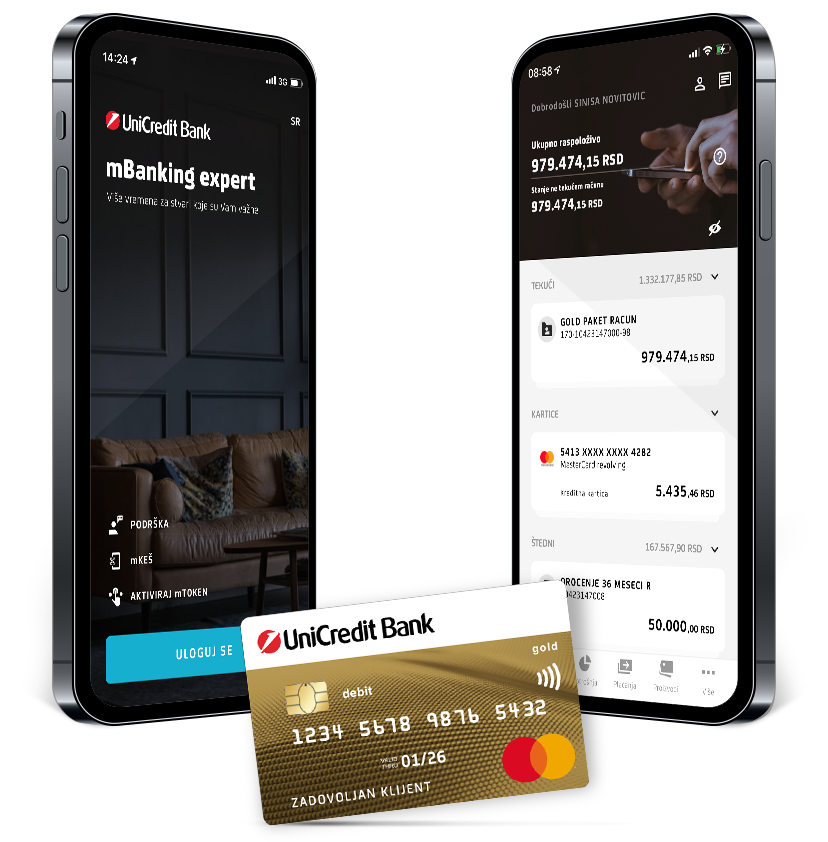

How can you protect yourself?For example, at UniCredit, all e-mails sent to Clients include the name, surname and branch reference. No link in the e-mail leads to a page with direct access to banking applications via the Internet. Even if you click on links in an email, the system never asks you to enter information such as card numbers, pin codes or passwords.

The evolution of phishing in recent years is related to the use of various communication channels used by the client, such as SMS, WhatsApp, Messenger, etc., through which the same type of attack is carried out by sending links from which it can be redirected to cloned pages. Such an attack is called Smishing. Another channel used to carry out phishing attacks is through phone calls, which goes by the name of Vishing. Official and institutional organizations do not ask for credit card numbers because they already know that.