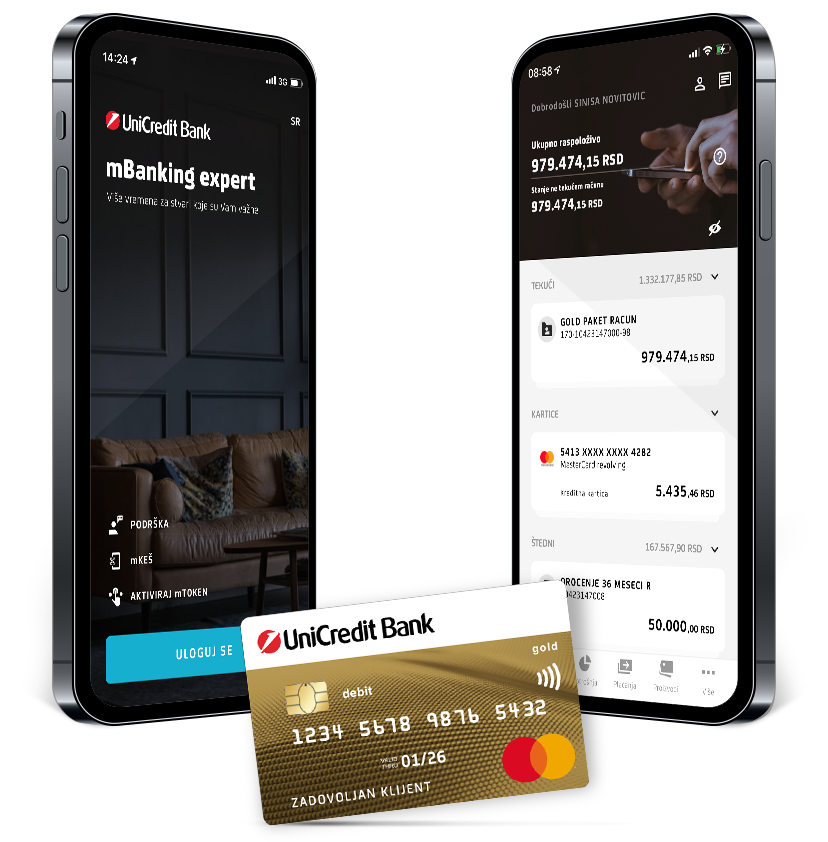

mBanking expert

Bank in your pocket

You do not have to waste your time to going to the branch. Download application for mobile banking and use banking services anytime, anywhere. You have overview of your accounts and transactions, bill payment and exchange office - in your mobile phone!